Trucking insurance premiums have risen significantly over the past few years, putting pressure on both large fleets and owner-operators. While some cost increases are unavoidable due to industry trends and claim severity, there are proven strategies that can help carriers reduce their insurance expenses without sacrificing coverage quality.

1. Improve Your Safety Profile

Insurance companies reward carriers with strong safety records. The better your safety metrics, the lower your premiums. Focus on:

- CSA Scores: Monitor your Compliance, Safety, Accountability (CSA) scores and address any safety violations quickly

- Driver Training: Invest in ongoing driver safety training and defensive driving courses

- Pre-Employment Screening: Use rigorous hiring practices to bring on safe, experienced drivers

- Safety Technology: Install dash cams, collision avoidance systems, and other safety tech that insurers recognize

2. Implement Telematics and Fleet Monitoring

Many insurers offer discounts for carriers that use telematics systems to monitor driver behavior. These systems track metrics like speeding, harsh braking, idle time, and hours of service compliance. By demonstrating improved driver behavior through data, you can negotiate better rates.

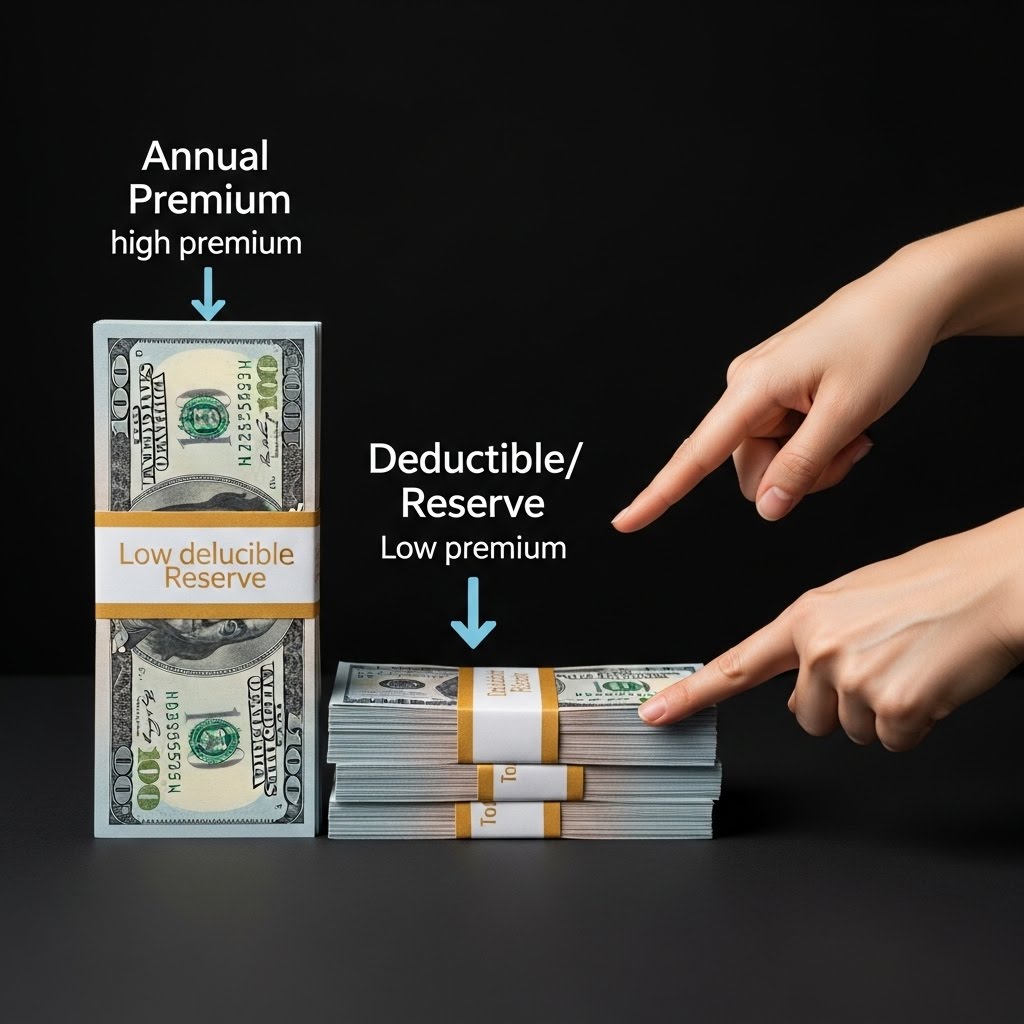

3. Increase Your Deductibles

One of the quickest ways to reduce premium costs is to increase your deductibles on physical damage and cargo coverage. While this means paying more out of pocket in the event of a claim, it can significantly lower your monthly or annual insurance costs. Evaluate your cash flow and risk tolerance to determine if higher deductibles make sense for your operation.

4. Maintain Clean Driving Records

Driver history directly impacts your insurance rates. Carriers with clean MVRs (Motor Vehicle Records) pay less. Implement policies that incentivize safe driving and immediately address drivers with violations or accidents. Some fleets use bonus programs tied to accident-free miles to encourage safer behavior.

5. Reduce Claims Frequency

Every claim you file can increase your premiums. Focus on preventing accidents and managing minor incidents without filing claims when financially feasible. Work with your insurance agent to understand your loss ratio and take proactive steps to reduce claims over time.

6. Shop Around and Negotiate

Don't automatically renew your policy without shopping around. Work with an insurance broker who specializes in trucking and can compare quotes from multiple carriers. Even if you're happy with your current insurer, getting competitive quotes gives you leverage to negotiate better rates.

7. Bundle Your Policies

Many insurers offer multi-policy discounts when you bundle liability, physical damage, cargo, and other coverages with the same company. Consolidating your insurance can simplify administration and reduce costs.

8. Perform Regular Vehicle Maintenance

Well-maintained equipment is less likely to cause accidents due to mechanical failure. Implement a preventative maintenance program and keep detailed records. Insurers view proactive maintenance as a sign of a well-run operation, which can translate to lower premiums.

9. Manage Your Credit and Business Financials

Some insurers use business credit scores as a rating factor. Maintaining strong business credit and healthy financials can improve your insurability and rates. Pay bills on time, manage debt responsibly, and keep your business finances in order.

Final Thoughts

Reducing trucking insurance costs requires a proactive, comprehensive approach that focuses on safety, risk management, and smart policy choices. By implementing these strategies, you can lower your premiums while maintaining the coverage you need to protect your business and stay compliant with FMCSA regulations.

Want to compare trucking insurance rates?

Guild Road Insurance Agency LLC works with multiple carriers to find you competitive rates. Let us help you reduce costs while maintaining excellent coverage.

Get a Quote